-

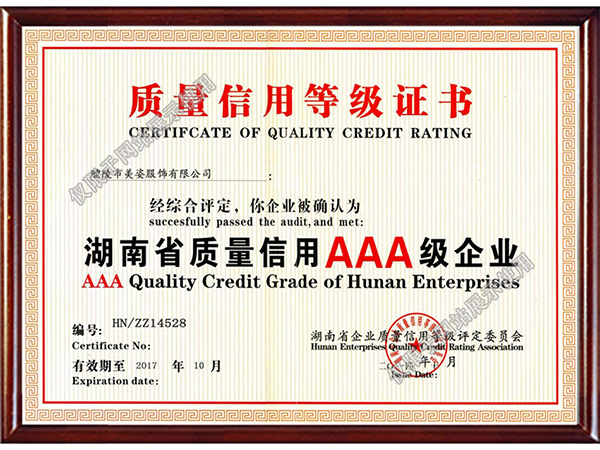

湖南省質(zhì)量認(rèn)證AAA級企業(yè)

醴陵市美姿服飾有限公司集服飾研發(fā)和生產(chǎn)銷售為一體,在不斷致力于現(xiàn)代服飾科技運(yùn)用,為國內(nèi)外消費(fèi)者提供具...

查看了解

-

社會(huì)勞動(dòng)保險(xiǎn)局認(rèn)證記錄

醴陵市美姿服飾有限公司集服飾研發(fā)和生產(chǎn)銷售為一體,在不斷致力于現(xiàn)代服飾科技運(yùn)用,為國內(nèi)外消費(fèi)者提供具...

查看了解

-

全國質(zhì)量、服務(wù)、信用AAA級企業(yè)

醴陵市美姿服飾有限公司集服飾研發(fā)和生產(chǎn)銷售為一體,在不斷致力于現(xiàn)代服飾科技運(yùn)用,為國內(nèi)外消費(fèi)者提供具...

查看了解

-

營業(yè)執(zhí)照

醴陵市美姿服飾有限公司集服飾研發(fā)和生產(chǎn)銷售為一體,在不斷致力于現(xiàn)代服飾科技運(yùn)用,為國內(nèi)外消費(fèi)者提供具...

查看了解

- 網(wǎng)站首頁

-

公司簡介

-

產(chǎn)品展示

城管制服標(biāo)志服綜合執(zhí)法服裝環(huán)境監(jiān)察標(biāo)志服農(nóng)業(yè)執(zhí)法標(biāo)志服交通制服標(biāo)志服應(yīng)急管理標(biāo)志服市場管理標(biāo)志服文化稽查標(biāo)志服動(dòng)物 標(biāo)志服水政制服標(biāo)志服120急救服衛(wèi)生應(yīng)急服裝西裝定制消防救援食品藥監(jiān)標(biāo)志服安全監(jiān)察標(biāo)志服衛(wèi)生監(jiān)督標(biāo)志服商務(wù)執(zhí)法標(biāo)志服林政制服標(biāo)志服司法制服標(biāo)志服質(zhì)監(jiān)制服標(biāo)志服民政制服標(biāo)志服漁政制服標(biāo)志服勞動(dòng)監(jiān)察標(biāo)志服鹽政制服標(biāo)志服國土監(jiān)察標(biāo)志服植檢執(zhí)法標(biāo)志服城建規(guī)劃市政保安治安協(xié)警標(biāo)志服裝配飾

-

企業(yè)榮譽(yù)

-

新聞中心

-

廠房廠貌

-

在線留言

-

聯(lián)系我們